The renewable diesel boom driven by a slate of federal and state policies has brought with it a surge in demand for imports of animal fats and vegetable oils to be used as feedstocks that could continue growing in 2025 as tax credits shift to incentivize domestic production of the fuel.

Source: Foreign Agricultural Service Report

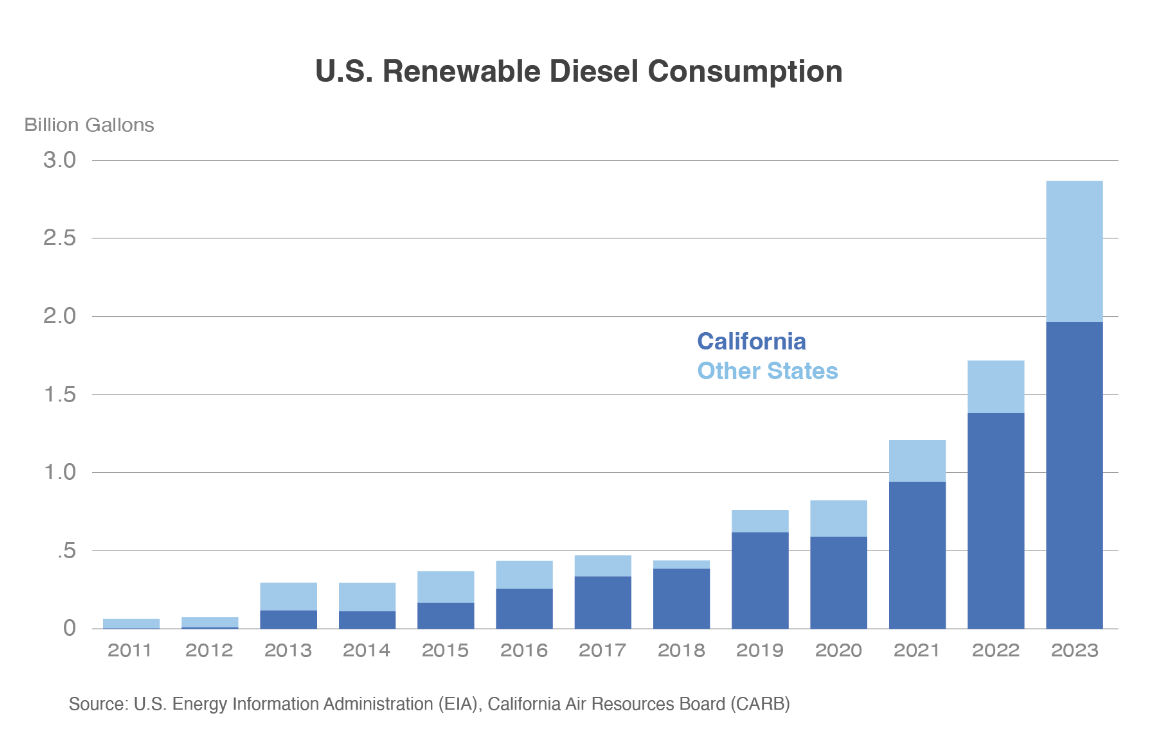

Source: Foreign Agricultural Service ReportDemand for renewable diesel has grown since 2015, largely as a result of increased demand in California due to the state’s Low Carbon Fuel Standard, according to a new report by USDA’s Foreign Agricultural Service. Growth in consumption in the state more than doubled between 2020 and 2023.

Two other policies — the national Renewable Fuel Standard and a blender’s tax credit — have also played a role in the boom, which has fueled demand for feedstocks such as yellow grease, soybean oil, corn oil, tallow and canola oil. While some had anticipated the increased demand would incite competition for feedstocks like soybean oil, the industry has so far been able to source much of its feedstocks from foreign markets.

“I don’t think today anybody’s having any problem finding feedstocks of vegetable oils,” economist Dan Basse, founder of AgResource Co., told Agri-Pulse. “Everybody is fairly comfortable with what’s here. I think there’s a little concern about 2025, but we just don’t know enough yet about the transition to biodiesel and new producer credits and all that will affect them.”

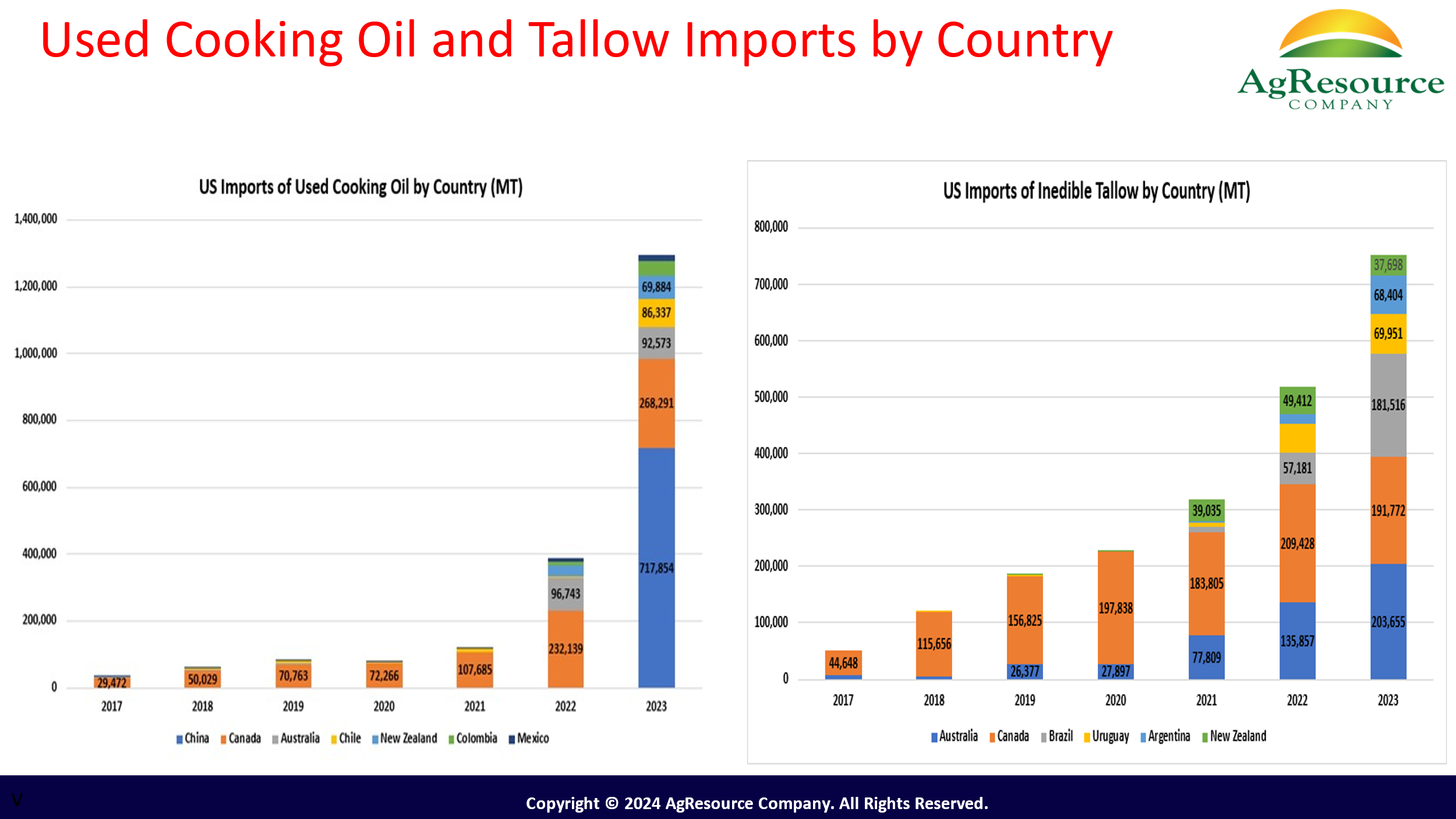

Imports of animal fat and vegetable oil more than doubled between 2020 and 2023, the Foreign Agricultural Service report says. Used cooking oils are a big part of the growth; imports from China more than tripled in 2023, according to the report. An analysis by American Soybean Association economist Scott Gerlt says used cooking oil imports went from less than 300 million pounds in 2021 to more than 3 billion pounds in 2023.

“China’s been huge there,” said Joe Glauber, senior research fellow at the International Food Policy Research Institute and former USDA chief economist. “That’s been a huge market for us.”

Imports of canola oil have also jumped from 2 million metric tons to more than 3.5 million metric tons amid policy changes that allowed canola to qualify under the Renewable Fuel Standard as a renewable diesel feedstock, according to the FAS report. Canada in particular is ramping up crushing capacity, North Dakota State University economist David Ripplinger told Agri-Pulse.

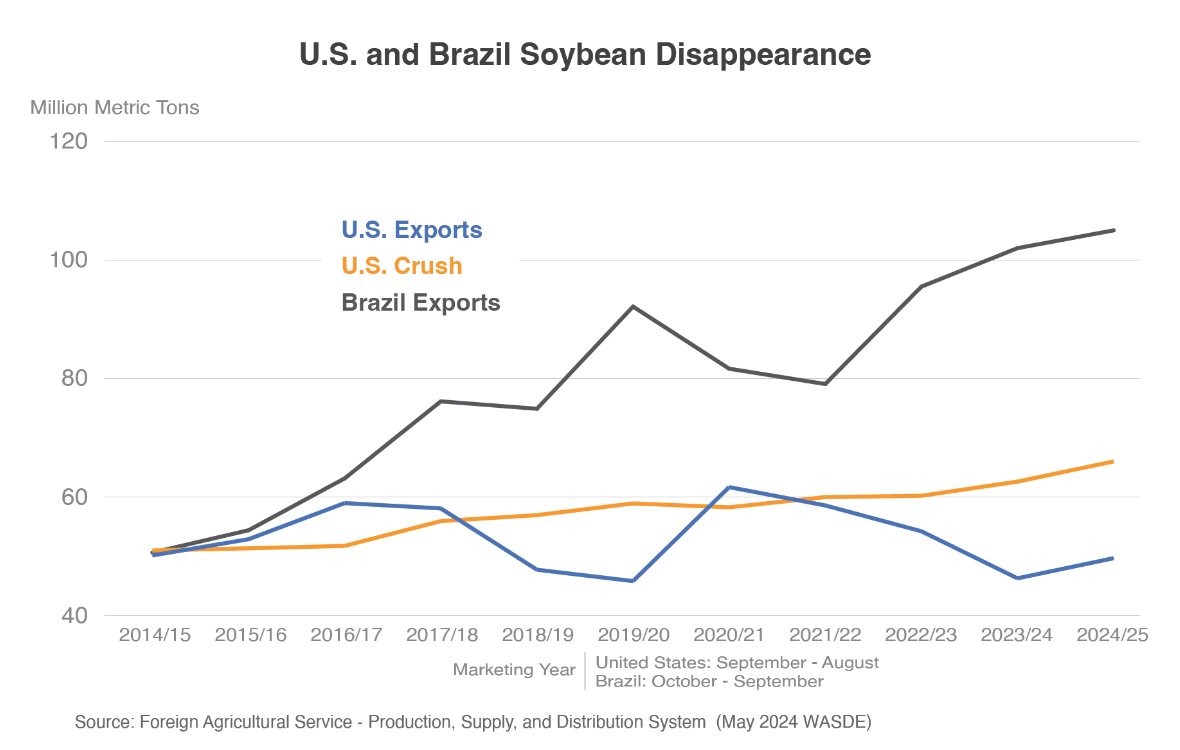

Renewable diesel demand also has driven additional soybean crush expansion in the United States, somewhat offsetting U.S. soybean exports challenged by competition with Brazil and reduced demand from China by pulling in some of the soy feedstocks, according to the report.

Credit: Dan Basse

Credit: Dan BasseIts role in soybean trade has been slightly more complicated. Soybean oil exports fell by 90% after renewable diesel first boomed in 2021 as a surge in demand for soy oil “created a scarcity in the domestic market, pushing the price U.S. buyers were willing to pay well above competitors’ prices in South America,” the report says.

“The drop in exports was so significant that the United States became a net importer of soybean oil (tonnage-basis) in 2023 for the first time ever,” the report says. “In fact, the price discrepancy was so massive that the United States did not experience an uptick in soybean oil exports in 2022/23" despite drought-reduced crops in Argentina, the world’s largest soybean oil exporter.

While soybean oil had a major role in the initial renewable diesel surge, it is now declining in appeal as a feedstock compared to alternatives like tallow and canola oil, the report added.

It's easy to be "in the know" about agriculture news from coast to coast! Sign up for a FREE month of Agri-Pulse news. Simply click here.

“With rising imports of lower carbon-intensity feedstocks and lower-cost Canadian canola oil, reliance on soybean oil for biomass-based diesel production has declined and domestic prices are responding,” it says. “If price premiums continue to fall, U.S. soybean oil exports could recover slightly.”

The increase in soybean crush capacity also led to greater supplies of soybean meal, which the U.S. has been exporting at increasingly higher rates. The report says 2024/25 soybean meal exports are expected at record highs of more than 15 million metric tons for the third year in a row.

Feedstock imports are projected to increase with demand for renewable diesel. While the future is unclear, economists agree that a policy shift limiting tax credits to domestic renewable diesel would further incentivize imports of feedstocks rather than already-created fuel. Biomass-based diesel imports averaged around one-fifth of production volume between 2019 and 2023.

A major question going forward is where this growth in feedstocks will come from.

“All the low-hanging fruit has been picked,” Ripplinger said of feedstocks to date. “Now, it’s ‘where do you get more?’”

The FAS report notes that imports of animal fats and vegetable oils are likely to expand, but growth could be constrained by feedstock availability.

Gerlt, the ASA economist, said renewable diesel producers will likely prefer capturing and using feedstocks like used cooking oil, which which can earn them higher 45Z tax credit amounts than soybean oil under the new GREET model, a method developed by the Energy Department for measuring the carbon intensity of biofuels. Used cooking oil could earn roughly 63 cents per gallon in credits, whereas oil from soybeans produced without conservation practices would bring some 34 cents a gallon.

Additionally, lower-carbon feedstocks like tallow, used cooking oil and corn oil see more West Coast market demand under California’s Low Carbon Fuel Standard than virgin vegetable oils like canola and soybean oil, according to the FAS analysis.

The future could bring challenges for trade of soy meal byproducts that are created through new crushing capacity. The report notes that last year, drought in Argentina limited its ability to compete, leading to more growth in U.S. soybean meal exports. But, as Argentina resumes production, there may not be enough room in the international market for both countries’ supplies. It’s possible the effects could be seen next year, Basse said.

Because meal production is linked to soybean oil production, lack of a market for the former could hinder continued growth as a renewable diesel feedstock for the latter, the report said.

“Unless we can build our feathered flocks up dramatically to somehow consume more meal on a global perspective, we end up with this abundance and then we end up with further pressure on on farm income and crush margins,” said Basse. “The investors that crush capacity in the soy industry get hurt and we end up in a rather dismal cycle, if you will, of oversupply, not only of feed grains, but also with soy products and vegetable oils.”

The only “light at the end of the tunnel” Basse sees is if other countries’ reach the limit to supplies of tallow or cooking oil they are able to provide or China ramps up renewable diesel consumption, which should raise soy oil prices and make it “the feedstock of choice” once more.

For more news, go to www.Agri-Pulse.com.