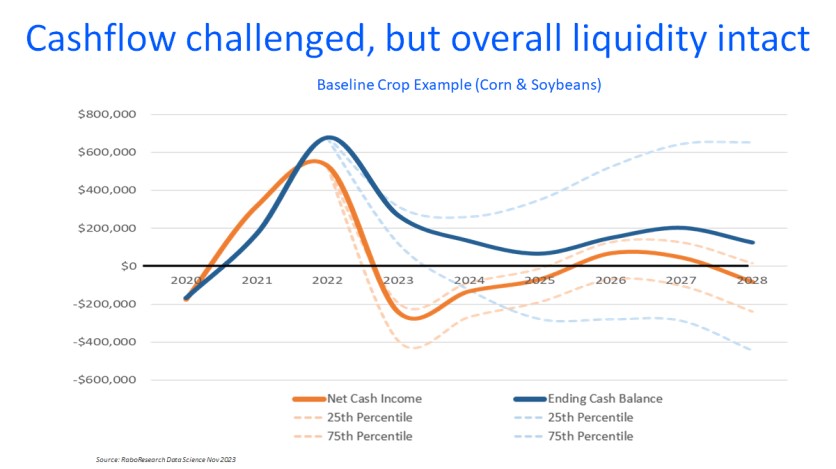

While some farmers are likely to see negative net cash farm incomes this year, many should have cash reserves from strong recent years to help carry them forward, a top ag economist says.

Roland Fumasi, head of RaboResearch Food and Agribusiness, said during a North American Agricultural Journalists’ Newsmaker webinar Wednesday that corn and soybean farms are going to have positive cash balances despite lower commodity prices for the next couple of years.

Fumasi said commodity prices are projected lower in the near-term but start to see a recovery by 2026 primarily led by the improved soybean market. “We’re bullish on the expansion of capacity for renewable diesel,” he said, indicating soybean margins strengthening with that new demand.

California is leading the way with renewable biodiesel, a much higher price premium product versus traditional biodiesel, Michael Swanson, chief ag economist at Wells Fargo’s Agri-Food Institute, said on the NAAJ webinar. He said renewable biodiesel and further out sustainable aviation fuels are really the “talk of the town” in establishing what a crop value will be worth going forward.

It’s easy to be “in the know” about agriculture news from coast to coast! Sign up for a FREE month of Agri-Pulse news. Simply click here.

But he said the CME futures contracts for corn and soybeans provides a skeptical view of renewable biodiesel. Corn prices look flat around $5 per bushel from 2024 until 2027, while soybean prices are declining significantly. This creates a ratio of 2.7 for soybeans to corn, but as you go further out on those contracts the ratio drops to a 2.1 to 2.2 range.

“If the renewable  biodiesel story was as strong as a lot of people would say it would, why would you see this declining value of soybeans relative to corn?” he asked.

biodiesel story was as strong as a lot of people would say it would, why would you see this declining value of soybeans relative to corn?” he asked.

U.S. soybean producers will likely export fewer soybeans moving forward and see Brazil and Argentina take on more world soybean exports, creating a different mentality in the soybean market than previously, Swanson said. “We see better value in the U.S. consumer as renewable fuel than we do from a global consumer as a feedstock for prime oil or the food ingredient.”

Dan Sumner, professor of agricultural and resource economics at University of California, Davis, said another issue in the renewable fuels discussion is how California treats biogas created from dairy and hog manure compared to other renewable sources.

“There are some people that say we don’t want any climate policy that provides any benefit to animal agriculture because those climate advocates are generally anti-animal to start with,” Sumner said.

Swanson added if battery-powered technology improves as fast as some people expect, it could create some “noticeable” erosion in renewable fuels and biodiesel.

If airlines' interest in more sustainable aviation fuel takes off, Fumasi does expect the capacity for sustainable aviation fuel to continue to expand and for that to “lengthen the runway for agriculture in terms of being able to provide and have a market in that area as some states move more towards electrification.”

Fumasi said he remains “bullish on the long run prospects for agriculture.”

RaboResearch is forecasting that the Federal Reserve will drop interest rates three times in 2024, fewer than others are projecting.

“We expect inflation to be stickier. And, while we do see unemployment rising, we see it rising a bit slower than what some others do,” Fumasi said.

For more news, visit www.Agri-Pulse.com.