Just over 3% of America's farm, ranch, and forest land is now owned by foreign buyers after overseas interests purchased another 3.4 million acres in 2022, according to a new Agriculture Department report.

Foreign investors owned or leased 43.4 million acres, or about 3.4% of the nation’s total farm, ranch and forest land, in 2022, according to the USDA’s most recent data on foreign land purchases. About 45% of the growth occurred in three states: Colorado, Alabama and Michigan.

Just because 3.4 million additional acres were added in the 2022 report doesn’t mean that land was purchased that year, according to Michigan State University Economist David Ortega.

“This is self-reported,” he said. “We don’t know if this increase that’s being reported is because of an actual increase in purchases or if it's just a reconciliation of past transactions.”

Under the Agricultural Foreign Investment Disclosure Act of 1978, foreign investors must file documentation with USDA detailing land acquisitions and dispositions or incur a late fee worth 0.1% of the land's value for each week purchases go unreported, with the penalty capped at 25% of the land's value.

Not every foreign entity that holds land files reports on time, however, and the USDA in recent years has struggled with the task of penalizing those that don’t. Talking points prepared for Ag Secretary Tom Vilsack in 2023, obtained by Agri-Pulse through a Freedom of Information Act request, say “poor record keeping” at the agency “resulted in inconsistent reports that could not be used as the basis to assess penalties” between 2016 and 2020. The document also pointed to “ very limited staffing” that also posed a challenge from 2015 to 2018.

In a March 2023 letter to Rep. Dan Newhouse, a Washington Republican who has been vocal on the issue, Vilsack said that from 2016 to 2020 USDA had only “two to three” national office employees to sift through the growing number of filings the agency received.

“At the time, given this limited staffing, priority was given to providing the most accurate data to Congress in the annual report over the issuance of penalties,” Vilsack wrote Newhouse.

providing the most accurate data to Congress in the annual report over the issuance of penalties,” Vilsack wrote Newhouse.

The agency last year hired six AFIDA specialists to better track filings and is once again assessing penalties; USDA assigned 14 to companies in 2022 and seven in 2023. Recent numbers may still be understated, however, due to AFIDA’s self-reported nature; the agency acknowledged in the report that the 2022 data “should be regarded as preliminary” because of late and incomplete filings.

Foreign investors reported 557,000 additional acres in Colorado in 2022, much of which was cropland and rangeland, according to the report. Some of this land was reported late; Canadian-owned High Lonesome Ranch was assessed a $7,579 penalty last year for not filing forms with USDA, while Roan Creek Ranch, also under Canadian ownership, had to pay $855 for the same reason.

Foreign holdings in Alabama and Michigan, meanwhile, grew by 514,000 and 461,000 acres, respectively. The report said these increases mostly stem from large forestland purchases.

It’s easy to be “in the know” about agriculture news from coast to coast! Sign up for a FREE month of Agri-Pulse news. Simply click here.

Not every state, however, saw foreign-held land increase. Six states — Arkansas, Illinois, Maine, North Carolina, Ohio, Oregon and Vermont — saw a combined 302,601 acres fall out of foreign investors' hands, either through land sales or the termination of long-term leases, according to the report.

Texas has over 5.4 million acres of foreign-held land, the largest amount of any state. Maine follows with almost 3.5 million acres. Most of the foreign-held land in these two states is forestland, the report says.

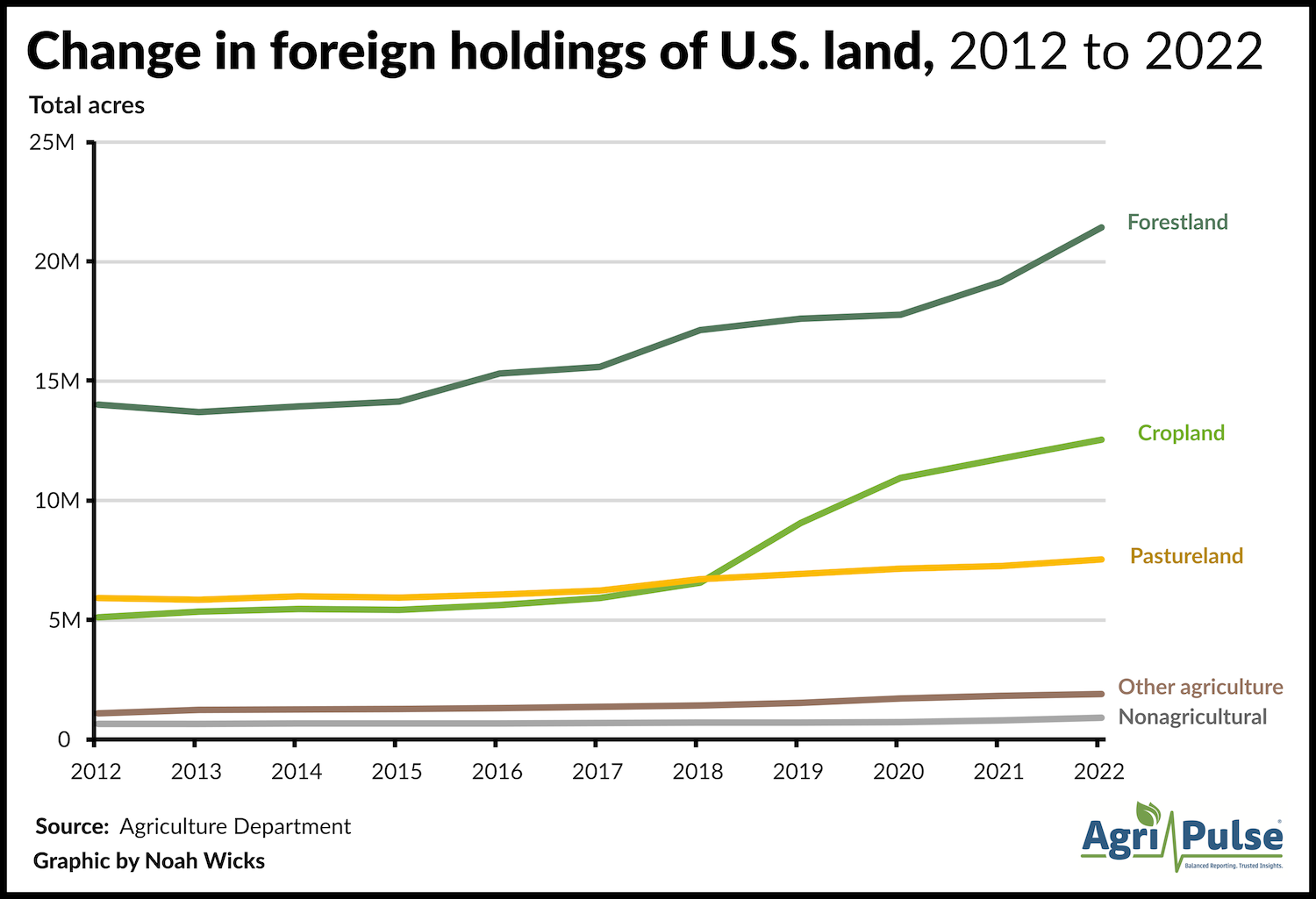

Foreign holdings grew at an average rate of about 600,000 acres per year between 2012 and 2017, and at nearly 2.9 million acres annually in the five years that followed. Forest land represents 48.3% of overall foreign landholdings, while cropland makes up 28.3%. Pasture and other agricultural land, meanwhile, collectively represent 21.3% of all foreign holdings, according to the report.

Wind developers are believed to possess at least a quarter of the overall acres of foreign-held land in the U.S. based on the presence of the word “wind” in their names, according to the report. These companies often sign long-term leases for land, though their overall footprint “is likely to be much smaller than the full parcel size that filers typically report.”

The agency is grappling with how to better identify and track leases of 10 years or more, which are currently captured alongside land purchases under AFIDA.

FSA's Steven Peterson asked for suggestions last month on whether long-term leaseholders, often wind and solar companies, should file their own version of the FSA-153 form, noting that current forms have “no specific questions” about leases.

“Long-term leases are a significant category of reports, and Congress and others have a strong interest in capturing leasing data,” Peterson said in the request for comment.

Investors from Canada, including both entities owned entirely by Canadians and by U.S. corporations with Canadian shareholders, hold 14.2 million acres of land, or 32% of all the foreign-owned land reported by USDA. Investors from the Netherlands followed, accounting for 12% of all foreign-held landholdings, while Italy and the United Kingdom each made up 6%.

Chinese landholdings, which have been a focus of concern for lawmakers in recent years, represent less than 1% of foreign-held agricultural acres, according to the report. Chinese investors and U.S. corporations with Chinese shareholders held 346,915 acres in total, and no land was held directly by the Chinese government.

“Chinese ownership of U.S. agricultural land, from the perspective of affecting our ability to produce food, is a nonissue,” Ortega said.

Approximately 87% of the reported Chinese holdings belong to five companies: Brazos Highland properties (102,345 acres), Murphy Brown LLC (102,345 acres) Murphy Brown of Missouri (42,716), Harvest Texas LLC (29,705 acres) and Walton International Group (29,437).

Brazos Highland Properties and Harvest Texas are Texas-based wind energy companies associated with Chinese Communist Party member Sun Guangxin, while Murphy Brown and Murphy Brown of Missouri are subsidiaries of pork giant Smithfield Foods. Walton International Group is a real estate investment and development firm with investors from around the world.

Lawmaker concern over Chinese landholdings has spawned at least 10 different legislative proposals to bar land purchases by investors from that country and other “foreign adversaries,” according to a recent analysis by the Congressional Research Service, though none have managed to make it through both chambers.

The Promoting Agriculture Safeguards and Security (PASS) Act, which would require the Committee on Foreign Investment in the United States to bar land purchases by investors “subject to the jurisdiction or direction of” the governments of China, Russia, North Korea and Iran from purchasing land, was approved as an amendment to the Senate version of the National Defense Authorization Act, but did not make it into the final version of the bill.

The Promoting Agriculture Safeguards and Security (PASS) Act, which would require the Committee on Foreign Investment in the United States to bar land purchases by investors “subject to the jurisdiction or direction of” the governments of China, Russia, North Korea and Iran from purchasing land, was approved as an amendment to the Senate version of the National Defense Authorization Act, but did not make it into the final version of the bill.

Chinese investor landholdings actually appear to have decreased from the 2021 foreign land report by 27,000 acres, though its authors noted that this is because they “incorrectly overstated” Chinese holdings in 2021 by not including information about changes in Brazos Highlands’ ownership.

“Harvest Texas acquired Brazos Highlands and while the acquisition for Brazos Highlands was entered in 2021, the disposition by Harvest Texas was not entered until this year,” the report said.

Fourteen foreign entities were hit with penalties in 2021 for reporting their landholdings late, including four subsidiaries of Chinese-owned seed and agrochemical giant Syngenta. The company, which is owned by the China National Chemical Corp., had to pay $46,976 that year for the violations.

Seven fines were imposed on foreign investors last year, including the assessments on High Lonesome Ranch and Roan Creek Ranch. Majority Canadian-owned power company Invenergy was assigned a $90,029 penalty for filing late, while Smithfield Foods subsidiary Murphy Brown was forced to pay $4,733.

For more news, go to Agri-Pulse.com.