President Donald Trump signed into law today the sweeping tax overhaul legislation that Congress passed this week, saying he wanted to make good on his promise to give Americans the holiday present he’d promised by Christmas.

Trump signed the bill – which he said represents “the biggest tax cut, the biggest reform of all time” – in a hastily-organized ceremony in the Oval Office before leaving for a holiday break at Mar-a-Lago, his resort in Florida. Republicans were able to push the bill through Congress against unanimous Democratic opposition.

"All of this, everything in here, is really tremendous things for business, for people, for the middle class, for workers," Trump said, with his hand resting on the bill, which looked to be about three inches thick. "I consider this very much a bill for the middle class and a bill for jobs."

When the bill cleared Congress on Wednesday, Zippy Duvall, the president of the American Farm Bureau Federation, said the legislation will result in lower taxes for the “vast majority” of the country’s farmers and ranchers.

“This tax overhaul includes many changes to the tax code, most notably lower individual tax rates, that will benefit farmers and ranchers,” Duvall said. “Ninety-four percent of farmers and ranchers pay taxes as individuals, and those rates are coming down. The bill also maintains all the important deductions and credits that farmers rely on. So, thanks to a lot of hard work by Congress and the administration, farmers will have both lower rates and all the tools they’ve always had to manage their businesses."

The bill lowers tax rates and creates a new 20-percent deduction on pass-through business income that are likely to lower farmers’ effective tax rate, which currently averages about 15 percent. It also nearly doubles the standard deduction for a couple to $24,000.

Patricia Wolff, who has been following the bill for the Farm Bureau, said it should mean a “significant tax cut” for most farmers, but she expressed concern that the individual tax provisions, including the pass-through deduction, expire after 2025.

Provisions doubling the estate tax exemption and expanding the Section 179 expensing allowance also would sunset. Trump specifically mentioned the estate tax provision as a boon for farmers before signing the bill.

The expiration dates were added to prevent the bill from increasing the deficit after 10 years, which would run afoul of Senate rules for bills considered under the budget reconciliation process. Republicans said a future Congress was unlikely to let the individual tax benefits expire.

But sunsetting the provisions also would make it more difficult for farmers to make long-term decisions, said Wolff. The Farm Bureau had long argued for repealing the estate tax on the basis that even if farms managed to stay under the exemption level the existence of the tax forced them to do costly estate planning.

“There’s no repeal and there’s no permanent exemption level” in the bill. “Any time you have uncertainty with the exemption you still have planning costs,” she said. “The same thing applies to the lower rates and the (20-percent) business deduction.”

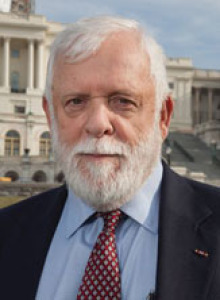

The National Farmers Union, which opposed the tax bill from the start, is mainly concerned about the projected $1.5 trillion increase in the budget deficit that would result from the tax cuts, Roger Johnson, the group’s president, said earlier this week. The deficit increase is likely to lead to GOP efforts to cut farm programs and other spending, he said.

“What congressional leadership has come up with is a patchwork of handouts for the wealthiest corporations and individuals in our country that will be paid for by family farmers, ranchers, the lower and middle classes, and our future generations,” he said.

But House Agriculture Chairman Mike Conaway, R-Texas, said the "historic tax relief package both simplifies our broken system and sets the economy on a course to stimulate growth and create jobs. ... From lower marginal rates to the treatment of pass-through income to improved small business expensing, this bill delivers for farmers, ranchers and all rural America.”

The National Restaurant Association also applauded Congress and the president for getting the bill done. Cicely Simpson, the group’s executive vice president for public affairs, called the legislation “the most substantive tax reform in a generation.” In a release, Simpson said “the historic bill will expand opportunity for all Americans, promote economic growth, and empower restaurants to succeed.”

Other provisions of the tax bill would:

- Repeal the Section 199 deduction that has been worth an estimated $2 billion a year to farmer cooperatives and their members. In return, both the co-ops and their members would be allowed to use the 20-percent deduction. The co-op portion of that deduction would cost the government about $415 million in lost revenue over 10 years.

- Increase the Section 179 expensing allowance to $1 million, with phaseout at $2.5 million. Under current law, Section 179 allows farms to expense up to $500,000 of the cost of equipment, buildings, breeding livestock and dairy cows. The allowance doesn't apply to used equipment and is phased out when the purchases exceed $2 million.

- Allow farms t

- o continue to expense interest costs and use the cash accounting method.

- Limit Section 1031 like-kind exchanges to real estate. They would no longer be allowed for equipment and livestock.

The president also signed the continuing resolution that will keep the governing running through Jan. 19.