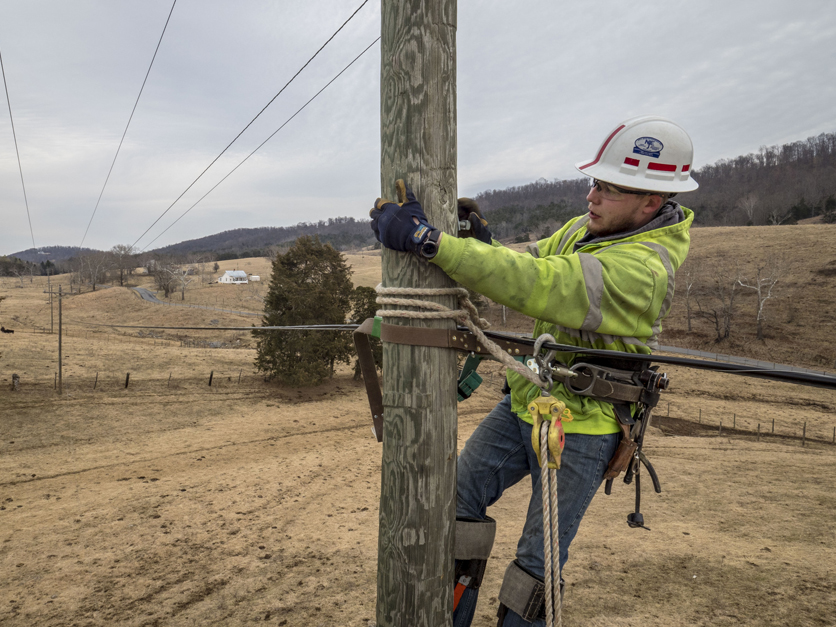

Ostego Electric Cooperative tried to do something about the broadband divide in rural America by getting a $4 million state grant to extend fiber optic cable for 500 miles through a remote part of central New York. What the co-op didn’t bank on was that the federal government would take a chunk of that money away in taxes.

But that’s what could happen due to a little-noticed provision in the 2017 Tax Cuts and Jobs Act, which was passed to slash corporate and individual tax rates.

Because of that provision, rural electric co-ops will now lose their nonprofit status if more than 15% of the revenue comes from federal, state or local governments. Government grants and subsidies are now deemed to be nonmember income.

Unless Congress acts to strike down the provision before Dec. 15, Ostego will have to borrow money to pay an estimated 2019 federal tax bill of about $1 million, said CEO Tim Johnson.

“We have to plan for the worst, hope for the best. We had done all our feasibility studies for this project based on tax-exempt status. This throws our projections off,” he said.

It’s not just rural broadband grants that are threatening co-ops’ tax-exempt status. Disaster assistance in the form of Federal Emergency Management Agency funding to rebuild damaged transmission lines can do the same thing.

For example, Gulf Coast Electric Cooperative in Panama City, Fla., is facing a tax bill for the aid it received to clean up and rebuild after Hurricane Michael. Co-ops in at least two other states, Wisconsin and Oregon, also face tax issues because of disaster assistance they have received.

“No one thinks this is a good idea,” said Jim Matheson, CEO of the National Rural Electric Cooperative Association, which is lobbying members of Congress to eliminate the provision. “They all acknowledge that this was a mistake, that it should not have happened.”

Jim Matheson, NRECA

The number of co-ops affected by the tax provision will vary by year depending on where natural disasters strike or whether co-ops want to take benefits like broadband grants. “You’re one event away from losing your (nonprofit) status,” he said.

But fixing the problem isn’t proving easy, and co-op officials fear the partisan impeachment battle could make it harder to get Congress to address the problem.

The provision caught co-ops by surprise after the tax law passed in December 2017, becoming President Donald Trump’s biggest legislative achievement so far. After learning of the issue, NRECA appealed to the Internal Revenue Service to rule that government grants wouldn’t be counted as non-member income, but IRS officials told the co-ops that the law was clear that government funding now counts as non-member income for the purposes of determining tax-exempt status.

The co-ops are now turning to Congress for a fix. There is broad bipartisan support in both chambers for eliminating the provision. It’s less clear how it will be done, especially given that the House Democratic leadership has been lukewarm about fixing problems with the 2017 tax law that was passed over united Democratic opposition.

A House bill to repeal the provision has 230 co-sponsors, more than a majority of the chamber. The lead sponsors are Alabama Democrat Terri Sewell and Nebraska Republican Adrian Smith, both members of the House Ways and Means Committee, which has jurisdiction over tax law. The bill is known as the RURAL Act, or "Revitalizing Underdeveloped Rural Areas and Lands Act of 2019.”

A similar bill introduced in the Senate by Minnesota Democrat Tina Smith and Ohio Republican Rob Portman has 27 other co-sponsors.

“Because of the mistake in the 2017 tax law, many cooperatives in Minnesota and across the country are in danger of being forced to choose between keeping their tax exemptions and accepting an important grant to clean up a disaster, or to expand much needed broadband services in a rural community," said Smith. "That uncertainty is making it difficult for them to effectively plan for the future — and it’s unnecessary.”

NRECA would like to get a separate vote on the bill in the House. It would almost certainly pass with a large majority, given the number of co-sponsors. But it’s more likely to become law if it’s attached to a larger must-pass bill.

That means the fate of the measure could be tied to a similar effort to revive a series of expired tax incentives, known as “extenders,” that include the lapsed $1-a-gallon tax credit for biodiesel.

A biofuel industry lobbyist said the tax extenders could be folded into whatever fiscal 2020 omnibus spending legislation Congress eventually passes. However, it’s also not at all clear when that spending measure will get done.

The continuing resolution currently funding the government expires Nov. 21, and the House and Senate have yet to agree on spending levels for any of the departments and agencies.

Ostego’s Johnson says the tax issue is far more serious for co-ops that have to rebuild after a disaster. His co-op could pay taxes at the 21% corporate rate and take bonus depreciation to lower its tax bill, although that solution creates other issues down the road.

“They have more of an existential issue. This won’t put us out of business, but when you’re rebuilding your whole system with FEMA money, this is really kicking dirt in your face when you’re down.”

For more news, go to www.Agri-Pulse.com.