Canola acreage expands amid renewable diesel growth

It was in a truck bound for Boise, Idaho, that the idea of planting canola occurred to Clint Anderson.

As Anderson, who farms near Potlatch, found himself driving past field after field of the golden-flowered crop on a spring haul, he considered giving it a try. Herbicide-resistant weeds were plaguing his wheat fields and he thought adding a new spring crop into the mix might help.

Now, four years later, Anderson grows nearly 1,000 acres of the spring oilseed. But he’s not the only producer betting on the crop. At the right time of year, if one were to climb the nearest mountain and look out over the hills Anderson’s farm is nestled in, he suspects they’d see patches of bright yellow dotting the landscape.

“It looks pretty,” Anderson said of the area’s increasingly numerous canola fields, adding that farmers are planting the crop for more than just its beauty. “They’re making money at it, too.”

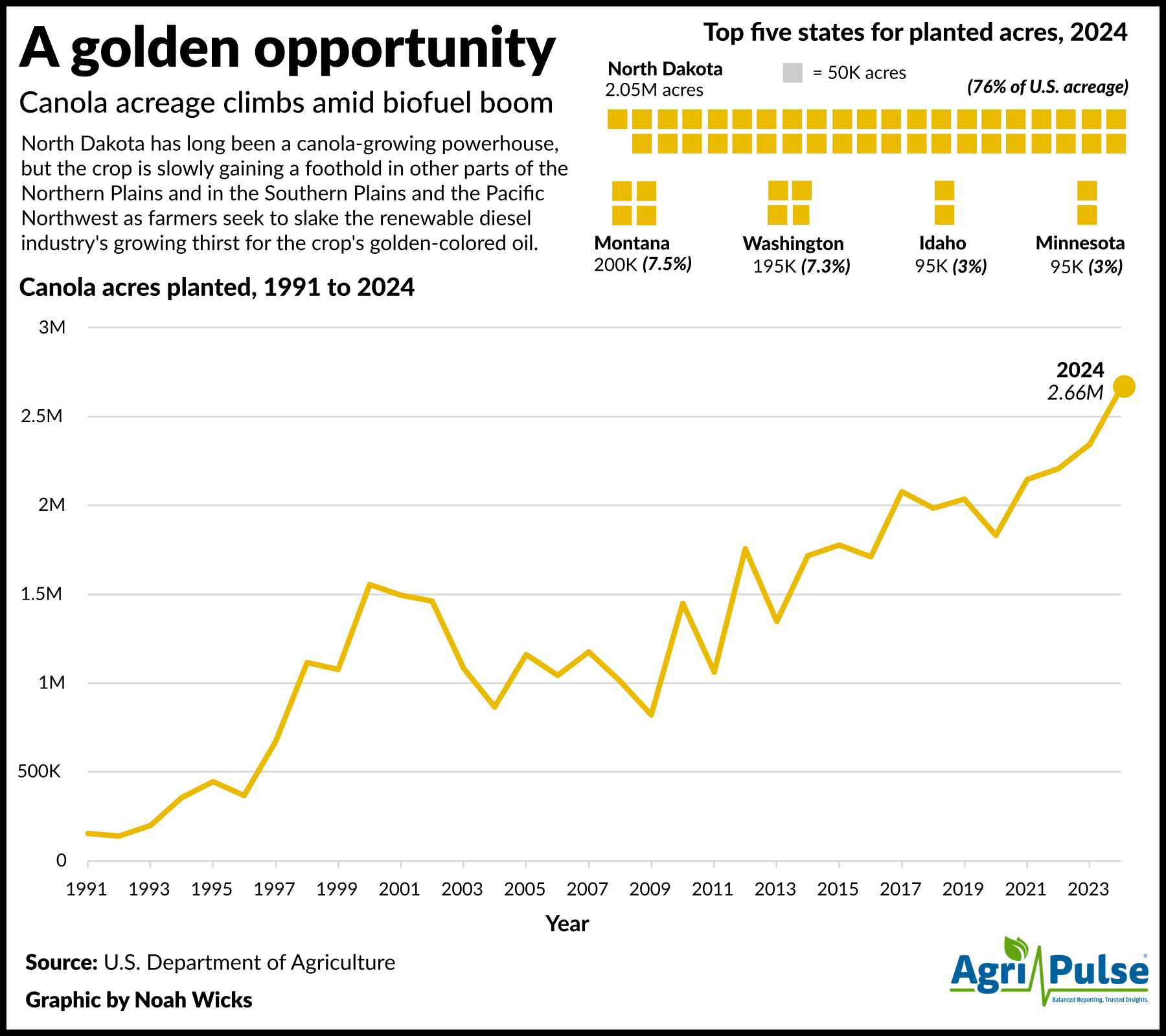

Fields bursting with bright yellow flowers have long dominated the landscape of North Dakota, a canola-growing powerhouse to which no other state compares. But farmers across the Pacific Northwest and the southern and northern Plains are steadily expanding their acreage as they seek to slake the renewable diesel industry's growing thirst for the crop's oil.

Canola was planted on 2.75 million acres in the U.S. in 2024, a 17.7% increase from the 2.34 million acres planted the year before and more than double what was planted in 2016, according to USDA National Agricultural Statistics Service estimates.

“I’d say in the last few years, biofuels demand has accelerated the rate of canola production,” said Tom Hance, executive director of the U.S. Canola Association.

So far, the growth in canola acreage doesn’t amount to what North Dakota State University economist David Ripplinger would call a boom. But it’s still significant, with the crop gaining a foothold in areas where it hasn’t traditionally been planted, like southeast North Dakota, he said.

“We could see a dramatic increase in acres planted in canola, especially if we consider winter canola,” Ripplinger said, though he added that it likely will always be dwarfed in acreage by corn and soybeans.

Canola hasn't always been a significant feedstock for biofuels, in part because of its value as a cooking ingredient. It was developed in the ‘60s and ‘70s by Canadian researchers aiming to create a safe, food-grade oilseed without the high quantities of erucic acid in rapeseed oil, the alternative at the time. Cooking remains a common use for canola oil, with 5 million pounds of U.S. supplies being used for food and other nonbiofuel purposes, according to USDA data.

An estimated 150 million pounds of U.S. canola oil supplies went into fuel production in fiscal 2008, the first year for which biofuel-related consumption data is available. But it wasn’t until 2010 that the Environmental Protection Agency approved a pathway for the crop as a biodiesel ingredient through the federal Renewable Fuel Standard. Usage grew to 645 million pounds in FY11 and 964 million in FY12.

Canola’s recent expansion, however, is shaped largely by renewable diesel, which, unlike biodiesel, is chemically identical to petroleum and can be directly used in diesel engines. U.S. refiners’ capacity to produce this fuel climbed from 791 million gallons per year in 2021 to 4.3 million gallons per year in 2024 as a stream of new plants were constructed to capture incentives from federal and state policies, like the RFS and California’s low carbon fuel standard.

It’s easy to be “in the know” about what’s happening in Washington, D.C. Sign up for a FREE month of Agri-Pulse news! Simply click here

Canola secured EPA approval as a renewable diesel feedstock under the RFS in December 2022. Within the fiscal year, the amount of U.S. canola oil used for biofuel purposes more than doubled from 1.3 million pounds to 2.9 million pounds, according to USDA estimates.

Canola’s success as a renewable diesel feedstock can be attributed in part to its high oil content, a trait beneficial for an industry angling to secure new sources of vegetable oil amid limited farmland availability. Canola seeds are roughly 40% oil, almost double the oil content of soybeans, according to University of Illinois economist Joe Janzen.

Canola seeds also generally create less meal than soybeans when crushed due to their high oil content. Crushing soybeans for similar quantities of oil tends to produce more meal, for which demand can be limited, Janzen said.

“The way that we can get to more oil and relatively less meal is to produce crops that have more oil,” Janzen said. “Canola fits the bill.”

As canola acreage expands to new areas, so too do crushing options. Bunge and Chevron plan to open a Louisiana facility able to crush winter canola in 2026. Scoular last year retrofitted a Kansas plant to be capable of crushing 11 million bushels of winter canola annually. It is also able to handle soybeans.

Jeff Frazier, a market development manager for Scoular, said producer interest in canola has “exceeded expectations” in the southern Plains, though the crop is not new to the region. Some farmers tried it as an alternative to winter wheat between 2010 and 2017, though interest fell in the years that followed due to limited processing options and recurring droughts, Hance said.

With the retrofitted Kansas plant now online, canola is “drawing a lot of excitement," Frazier said. Scoular has fielded “hundreds of calls” from growers as far south as Waco, Texas, he added.

“It’s another winter option, which is kind of what we need,” said Texas panhandle farmer Ethan Weinhamer, who was searching for a tap-rooted cool season crop able to pull moisture from deep within the soil. He seeded around 1,000 acres of winter canola last fall, with the intention of selling what emerges to the Scoular plant.

Still, canola doesn’t handle hot, dry temperatures while flowering, a barrier to expansion in certain regions, Janzen said. Drought can hinder yields, even in locations generally favorable to the crop. Pullman, Washington, farmer Kyle Kammerer faced this challenge last year when a heat wave baked his fields for two weeks in early July, when the crop was in full bloom.

Still, canola doesn’t handle hot, dry temperatures while flowering, a barrier to expansion in certain regions, Janzen said. Drought can hinder yields, even in locations generally favorable to the crop. Pullman, Washington, farmer Kyle Kammerer faced this challenge last year when a heat wave baked his fields for two weeks in early July, when the crop was in full bloom.

Policy limitations limit expansion elsewhere. Oregon, for instance, bars Willamette Valley farmers from collectively growing more than 500 acres of the crop due to concerns it will cross-pollinate with other types of brassicas, such as kale, cabbage, brussels sprouts, broccoli and cauliflower.

Industry leaders are also concerned about future canola growth being stifled under a proposal for a 20% cap on biofuels made from canola and soybean oils in California’s low carbon fuel standard, the program driving much of renewable diesel’s current growth. Last August the U.S. Canola Association put out a statement calling the proposal, currently being considered by the California Air Resources Board, “arbitrary, unnecessary and unwise.”

While the U.S. is seeing its canola crush infrastructure expand to support policy-driven markets for the crop’s oil, Canada is experiencing a similar trend, Ripplinger said. By the end of this year, Canadian processing capacity is expected to grow 24% from last March, according to the USDA Foreign Agricultural Service. Two more plants are slated to be completed as early as 2026.

The influx of Canadian plants is likely to drive more canola production in the upper Midwest, Ripplinger added. “We could have material bouncing back and forth across the border pretty easily,” he said.

For Kammerer, growing glyphosate-resistant canola has helped deter the Italian ryegrass that has “exploded” in his fields in recent years. Demand for canola is an added benefit, he said, but being able to spray for weeds is what has given it a permanent place in his rotation.

“I think there’s a place for it. There will be on our farm for sure,” Kammerer said of the crop, adding, “I hope we don’t outrun the market, though, and get too big, too fast.”

For more news, go to www.agri-pulse.com.