Lawsuits, legislation could short-circuit wind, Clean Power Plan

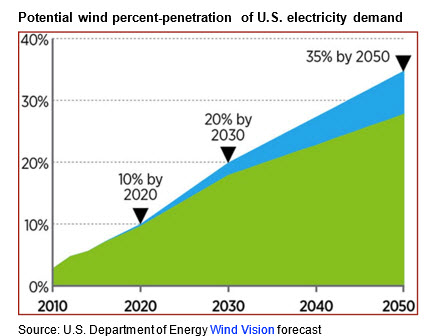

WASHINGTON, Oct. 28, 2015 - If the right

energy policy choices are made, the Department of Energy forecasts that wind power's current 4.5 percent of the

nation's end-use demand could surge to 10 percent by 2020, 20 percent by 2030

and 35 percent by 2050.

The

policy choices include a rapid shift from coal power to wind and solar – a

shift that’s key to the Obama administration’s Clean Power Plan (CPP) to limit carbon emissions from

coal-fired power plants for the first time. But the administration’s ability to

implement the CPP and its other climate  programs will be decided by how the

courts rule on a flood of lawsuits filed Friday by West Virginia and 25 other

states along with business and industry organizations and individual

businesses. The suits charge that EPA has exceeded its legal authority in its

CPP rules. Another 15 states including New York, California, Illinois and Iowa

support the CPP.

programs will be decided by how the

courts rule on a flood of lawsuits filed Friday by West Virginia and 25 other

states along with business and industry organizations and individual

businesses. The suits charge that EPA has exceeded its legal authority in its

CPP rules. Another 15 states including New York, California, Illinois and Iowa

support the CPP.

The

lawsuits’ initial goal is to have the courts issue a stay order to prevent EPA

from enforcing its CPP rules until there is a final court decision on whether

the EPA has the legal authority to implement the plan. Karen Harned, executive director of the National Federation of

Independent Business small business legal center, said in a call with reporters

Monday that the courts need to block EPA’s Clean Power Plan because EPA is

“doing expressly that which Congress has already rejected.”

In

filing suit Friday, U.S. Chamber of Commerce President and CEO Thomas Donohue

charged that “The EPA’s rule is unlawful and a bad deal for America. It will

drive up electricity costs for businesses, consumers and families, impose tens

of billions in annual compliance costs, and reduce our nation’s global

competitiveness, without any significant reduction in global greenhouse gas

emissions.”

In contrast to the dire warnings in the

lawsuits, the Energy Department’s March 2015 report, Wind Vision: A New Era for Wind Power in the

United States, states that with

wind power costs down more than a third since 2008 thanks to new technology,

construction of a domestic manufacturing base, and economies of scale, it has

already been established that “utility-scale wind power is a cost-effective

source of low-emissions power generation.”

Another

key point in the DOE report is that wind’s current trajectory indicates that if

wind continues to gain market share, U.S. electricity consumers will be major

beneficiaries. By 2050, the report sees the payoff from wind power’s potential

growth including $149 billion saved on consumers’ electricity bills and $280

billion in savings from lower fossil fuel prices. As a bonus, the report says

the switch to wind would reduce the electric power sector’s water use by 23

percent.

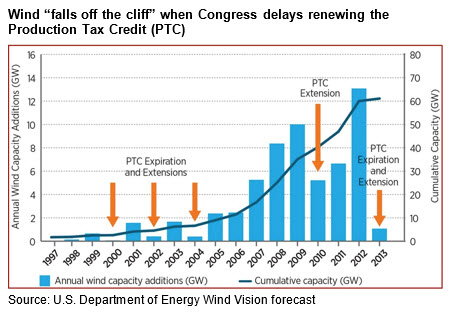

All

bets are off, however, if Congress either passes legislation to rescind the

Clean Power Plan or once again fails to renew the Production Tax Credit (PTC)

and Investment Tax Credit (ITC) for wind which expired in 2014. These

short-term tax credits are intended to offset the fossil fuel industry’s

permanent tax breaks and to reflect the health and environmental benefits

provided by energy sources which reduce carbon emissions. As shown by the DOE

chart above, wind’s growth has slowed precipitously whenever Congress has let

the PTC and ITC lapse. Not shown in the chart: the thousands of jobs lost,

manufacturing plants closed, and billions in investment dollars switched to

overseas projects whenever the tax credits are in doubt.

(PTC)

and Investment Tax Credit (ITC) for wind which expired in 2014. These

short-term tax credits are intended to offset the fossil fuel industry’s

permanent tax breaks and to reflect the health and environmental benefits

provided by energy sources which reduce carbon emissions. As shown by the DOE

chart above, wind’s growth has slowed precipitously whenever Congress has let

the PTC and ITC lapse. Not shown in the chart: the thousands of jobs lost,

manufacturing plants closed, and billions in investment dollars switched to

overseas projects whenever the tax credits are in doubt.

In

its third-quarter U.S.

Wind Industry Market Report released Oct. 22,

the American Wind Energy Association (AWEA) says that the industry is on track

to achieve DOE’s ambitious growth targets. But it also warns that the momentum

could be halted once again if Congress fails to renew the PTC and ITC tax

breaks.

Explaining

the report’s findings, AWEA CEO Tom Kiernan said that “We are on the cusp of

greatness. There are over $20 billion worth of wind farms under construction

right now, creating well-paying jobs and spurring economic development in rural

communities across the country.” But he warned, “This growth is in jeopardy,

however, as continued policy uncertainty could throw the wind industry off yet

another economic cliff.”

One

measure of the threat is that wind installations dropped 92 percent in 2013

when Congress failed to renew wind’s tax breaks. “Extending the Production Tax

Credit and the Investment Tax Credit this year for the longest practical term,”

Kiernan said, “will help wind power grow our economy and deliver more savings

to American homeowners and businesses.”

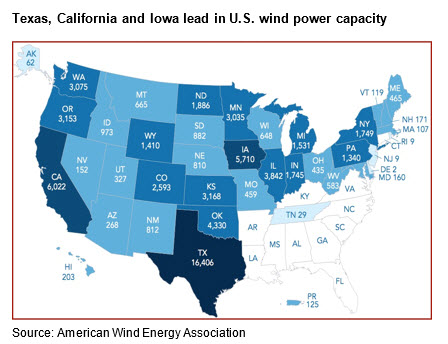

The

AWEA report shows that over 1.6 gigawatts (GW) in new wind capacity was

installed for the third quarter of 2015, resulting in nearly 3.6 GW added for

2015 so far. This pace more than doubles the capacity installed for the same

period in 2014 and brings total U.S. installed wind capacity to 69.47 GW, which

is enough to power 18 million average American homes.

Looking

forward, the report finds that a near-record of more than 13.25 GW of wind

capacity is under construction in the U.S., with an additional 4.1 GW in

advanced stages of development. Completion of these projects would bring total

U.S. capacity to 86.8 GW. Those figures put the industry on track to achieve

DOE’s Wind Vision goals of U.S. installed wind capacity of 113 GW by 2020, 224

GW by 2030, and 404 GW by 2050. As part of that growth, DOE sees the potential

for 22 GW of offshore wind capacity installed by 2030 and 86 GW by 2050.

AWEA

notes that the third quarter also saw North Carolina launch its first-ever wind

farm, becoming the 40th state with commercial-scale wind power generation.

AWEA

adds that corporations including Amazon and Hewlett-Packard and a growing list

of U.S. cities have signed wind power purchase agreements for 20 years or longer.

“These long-term contracts help non-utility purchasers of wind to hedge against

the risk of increasing fuel costs by locking in low, fixed-cost rates for wind

energy output,” AWEA explains, pointing out that “These commitments also help

companies and cities to achieve their internal carbon reduction targets.

In

a webcast about AWEA’s 3Q report, Kevin Helmich, Iberdrola Renewables’ managing

director for Midwest and Eastern origination, said that in order for wind to

give consumers new savings and reliability opportunities, “We encourage

Congress to continue affording those opportunities by extending the renewable

Production Tax Credit to enable the construction of thousands of additional

megawatts to serve consumers large and small with affordable, clean power.”

The

latest AWEA numbers confirming wind power’s rapid growth come at a critical

time. Wind power is a key part of the administration’s Clean Power Plan (CPP) And the CPP is a key part of the administration’s

effort to persuade other countries to commit to equally bold carbon emissions

limits when the international climate summit is held in Paris Nov. 30 to Dec.

11.

But

coinciding with the anti-CPP lawsuits filed Friday, Senate Environment and Public

Works Committee Chairman Jim Inhofe, R-Okla., joined Senate Majority Leader

Mitch McConnell, R-Ky., and Sen. Shelley Moore Capito, R-W.Va., in sponsoring

congressional resolutions to rescind the Clean Power Plan.

Aiming

his remarks directly at the climate summit in Paris, Inhofe said that

rescinding the CPP is “intended to make it very clear to the international

community that the majority of Congress does not support the president’s

climate agenda. The majority of Congress does not support any effort to fund

his climate agenda, and any associated promises made by this administration,

whether through political or legal means, will be short-lived.”

DOE’s

Wind

Vision report forecasts that a rapid

transition from coal to wind by 2050 would reduce electricity costs and

generate hundreds of billions of dollars in savings along with environmental

and health benefits. In sharp contrast and echoing the anti-CPP lawsuits,

Inhofe charges that implementing the CPP “will cost over $192 billion, increase

the price of electricity, reduce grid reliability, and have no considerable

impact on the environment.”

Oklahoma’s

other U.S. senator, Republican James Lankford, has introduced his PTC

Elimination Act to “phase out

federal renewable energy tax credits, including wind, by 2026.” He says that

while he supports wind as part of an all-of-the-above energy strategy, wind has

become “a self-sustainable, multibillion dollar industry” so that “there is no

need for the taxpayer to continue to subsidize a wind start-up tax credit.”

#30