The Agriculture Department is significantly increasing its farm earning forecast for 2022, estimating net cash farm income will reach its highest level in a decade due to the booming prices for crops and animal products.

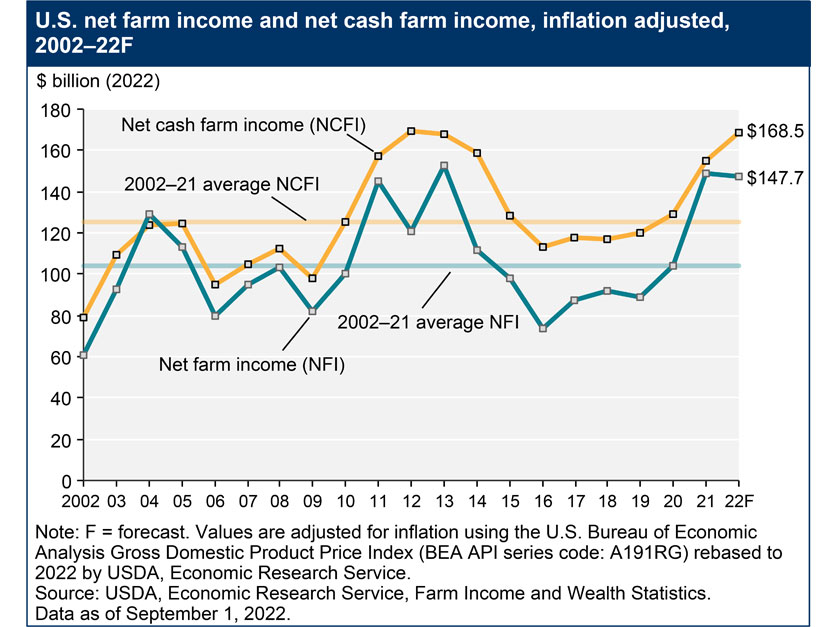

Net cash farm income is now forecast at $168.5 billion in 2022, an increase of $22.1 billion — or 15.1% over 2021 — and the highest level since 2012 when adjusted for inflation, USDA’s Economic Research Service said Thursday.

Net farm income, a broader measure of profits, is forecast at $147.7 billion in calendar year 2022, an increase of $7.3 billion, or 5.2%, over last year.

In February, USDA forecast net farm income at $113.7 billion in 2022 and net cash farm income at $136.1 billion.

Net cash farm income is based on cash receipts from farming, plus government payments and other farm-related income, minus cash expenses. Net farm income also factors in depreciation and changes in inventory values.

The stronger forecast reflects sharply higher estimates of crop and livestock revenue. The February forecast was issued ahead of a steep run-up in market prices that resulted from Russia’s invasion of Ukraine.

USDA now estimates cash receipts from the sale of agricultural commodities will soar by 21.2% — $91.7 billion — this year to $525.3 billion. February’s forecast was for an increase of 6.8%, or $29.3 billion, in 2022.

Crop receipts are now estimated to jump by 15.3%, or $36.4 billion, led by an inflation-adjusted 23% increase in soybean revenue, a 10% increase in corn receipts and a 26% increase for wheat.

Sales of animals and animal products are forecast to skyrocket by 28.3%. Revenue from broilers is forecast up 48% this year, adjusted for inflation, while egg receipts are estimated to increase by nearly 67%. Dairy sector revenue is forecast to increase by 29%.

But farms will actually see their earnings lower this year compared to 2021 because of the combination of higher input costs and a decline in government payments due to the end of pandemic assistance and reduced disaster aid, according to USDA.

For the latest on what’s happening in Washington, D.C. and around the country in agriculture Sign up for a FREE month of Agri-Pulse news! just click here.

Farms producing corn are expected to see their net cash income drop by about 4.3% this year, when adjusted for inflation, while soybean growers will see an estimated drop of 10.2%. Wheat and cotton growers will see even larger drops in net cash farm income of 35.5% and 25.7% respectively.

Farmers’ production expenses are forecast to be up this year by $66.2 billion, a 17.8% increase to $437.3 billion, reflecting sharply higher input prices. Producers' total fertilizer bill is expected to hit $45 billion this year, up from $29.5 billion in 2021.

Citing higher input costs, many farm groups are urging Congress to increase funding for farm bill commodity programs in 2023 in order to raise the reference prices that trigger payments under the major commodity programs for grains and oilseeds.

Farmers' debt-to-asset levels are expected to decline from 13.5% in 2021 to 12.9% in 2022. But working capital, which measures the amount of cash available to fund operating expenses after paying off debt due within 12 months, is expected to be 2.6% lower this year.

For more news, go to www.Agri-Pulse.com.