WASHINGTON, April 12, 2016 - Secretary of State John Kerry focused on climate change and renewable energy in a speech last week at the invitation-only Future of Energy Summit in New York, asserting that “clean energy is one of the greatest economic opportunities the world has ever seen.”

“Investing in clean energy just makes good business sense,” Kerry said, adding: “In the long term, carbon-intensive energy is one of the costliest investments that any civilization could choose to make.

Answering climate sceptics who say they’re not scientists, Kerry explained that “Basic physics – the kind that kids learn in high school – tells us that when temperatures go up, glaciers and ice sheets melt faster, and sea levels rise faster.” He warned that unless the world accelerates its shift to renewable energy, the prospect is for “stronger storms, longer droughts, food shortages, food insecurity, battles over water, disease outbreaks, mass migrations, and the potential collapse of entire ecosystems.”

Kerry pointed out that, “for the first time in history – despite the low price of coal, oil, and gas – more of the world’s money was spent fostering renewable energy technologies than was spent on new fossil fuel plants. That’s a revolution.” And it’s happening in both industrialized and developing countries.

“In fact, emerging economies like China, India, and Brazil invested even more in renewable technologies last year than the developed world. China alone invested more than $100 billion dollars…..But the truth is, we still have a long way to go to get to where we need to be,” Kerry said.

“Even though renewables made up more than 50 percent of all new electricity installations last year….. because of the existing energy infrastructure already in place, they only generated a little more than 10 percent of the world’s energy,” Kerry added. “And in a modern world, that’s just simply an unacceptable level of inefficiency.”

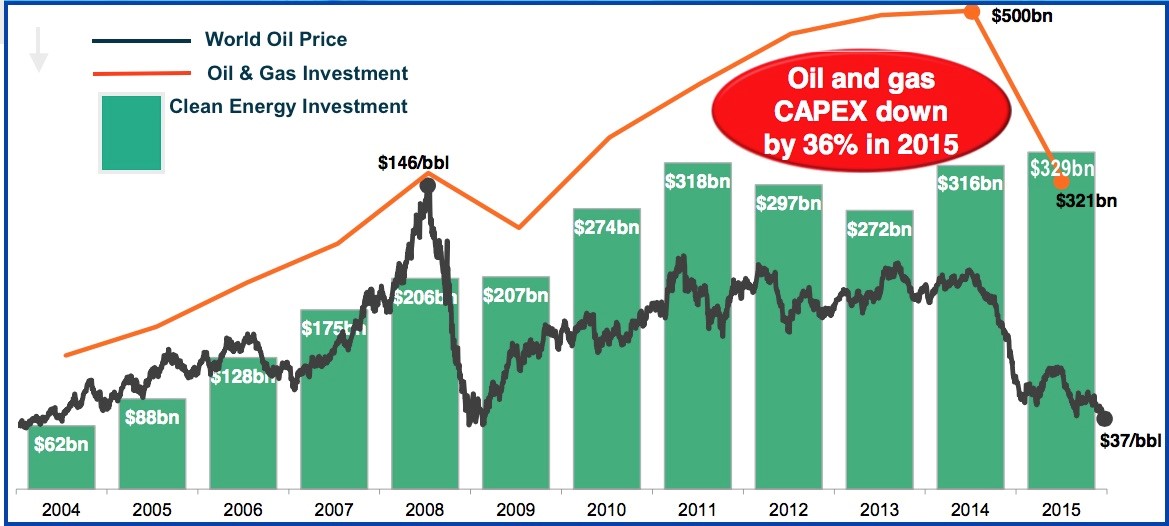

Clean energy investment rose while oil and gas prices and investment fell

Source: Bloomberg Intelligence, Michael Liebreich at Bloomberg New Energy Finance Summit

Michael Liebreich, the founder and advisory board chair of Bloomberg New Energy Finance (BNEF), which hosted the energy summit, followed Kerry’s dire warnings by delivering good news: Global clean energy investments rose to a record $329 billion for 2015, for the first time surpassing oil and gas industry investments, which dropped 36 percent to $321 billion, from 2014’s $500 billion.

The two countries leading in 2015’s clean energy investments were China, increasing its investments by 17 percent to $110.5 billion, and the U.S., up 8 percent at $56 billion.

Liebreich predicted “a low-cost-of-oil environment for the foreseeable future.” He pointed out that $40-per-barrel oil has triggered sharp cuts in oil industry investment but that renewable energy investment has risen. He said the difference is that, thanks to improving technology and economies of scale, every doubling in wind power generation has cut wind costs by 19 percent and every doubling in solar power generation has cut solar costs by 24 percent, making renewables increasingly competitive.

BNEF figures show that renewable sector investments resulted in 2015’s record renewable power installations. Liebreich called the new records “a stunning riposte to all those who expected clean energy investment to stall on falling oil and gas prices” and said they “highlight the improving cost-competitiveness of solar and wind power.”

International Renewable Energy Agency (IRENA) Director-General Adnan Z. Amin is equally upbeat. “Renewable energy deployment continues to surge in markets around the globe, even in an era of low oil and gas prices,” he reports. “Falling costs for renewable energy technologies, and a host of economic, social and environmental drivers are favoring renewables over conventional power sources.” He adds that the rapid growth of renewables “sends a strong signal to investors and policymakers that renewable energy is now the preferred option for new power generation capacity around the world.”

Frank Maisano, an energy policy expert at Washington’s Bracewell & Giuliani law firm, cautions, however, against expecting continuing oil industry problems.

“I wouldn’t put too much into the numbers as the oil/gas industry is in a significant downturn now that certainly won’t continue,” he says. He argues that the surge in renewable energy is partially dependent on the natural gas industry growing to compensate for the intermittency of solar and wind power generation.

Among energy industry analysts, many join IRENA’s Amin in forecasting that oil prices will remain at or near the current $40 level for perhaps a year or more. Others predict a rebound.

Cornerstone Analytics founder Mike Rothman sees oil more than doubling to reach $85 by the end of this year. Only slightly less bullish, Pierre Andurand, the chief investment officer of his London-based hedge fund Andurand Capital, predicts a “multiyear bull run” for oil prices, starting with $60 to $70 oil by the end of this year and $80 per barrel in 2017, climbing back toward June 2014’s peak of $114 per barrel.

One new factor amid the wide range of forecasts for oil prices is that the latest figures show renewable energy on a rapid but steady growth path no longer tied to oil price volatility – leading more major power generating companies to add renewables to their energy mix.

Thomas Fanning, CEO of Southern Company, a major utility investing heavily in clean coal and nuclear power as well as renewables, told the Summit that the administration’s Clean Power Plan to reduce carbon emissions from power plants is “federal overreach.”

But instead of rejecting renewable energy, Fanning explained that his company has “reduced our carbon footprint voluntarily with no cap and trade, no carbon tax, no carbon regime whatsoever, by the natural evolution of our portfolio in the Southeast. We have reduced our carbon footprint about 26 percent since 2005, which far exceeds any other effort by Congress. We can do these things in a rational way by doing national energy policy in a rational way.”

#30

For more news, go to: www.Agri-Pulse.com