WASHINGTON, July 8, 2015 – U.S. exports of denatured and undenatured ethanol in May declined for the second month in a row, while exports of U.S. distillers dried grains with solubles (DDGS) soared, according to a new analysis of government data developed by the Renewable Fuels Association (RFA).

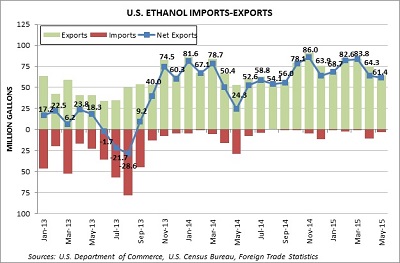

Ethanol exports dropped 14 percent from April to 64.6 million gallons (mg), with the largest cutbacks in Tunisia, India, the Netherlands and the Philippines. Canada (19.3 mg, or 30 percent), Brazil (13.8 mg, or 21percent) and Oman (12.6 mg, or 20 percent) accounted for the bulk of exports in May, rounded out by the Philippines (4.1 mg) and Mexico (4.0 mg). Year-to-date exports of 377.1 mg implied an annualized total of 905 mg for 2015, which would surpass all years but 2011, according to RFA.

Inbound shipments of ethanol were dramatically lower in May, with the U.S. taking delivery of 3.2 mg of denatured product from the Netherlands and 33 gallons from Germany. Total year-to-date imports of 16.4 mg are less than a third of imports at this time last year. In May, the U.S. claimed its 22nd month in a row as a net exporter.

May exports of U.S. distillers dried grains with solubles (DDGS)—the animal feed co-product manufactured by dry mill ethanol plants—surged 23percent over April levels, marking the second biggest monthly jump on record, according to RFA.

May shipments of DDGS were 1,171,916 metric tons (mt), topping the 1.1 million mt mark for only the third time. Monthly exports to China were at an historic high of 864,777 mt in May—notably assuming the largest market share to date at 74 percent of total U.S. DDGS exports. However, market gains in other regions have suffered in the wake of China’s return, with larger losses seen in Mexico, Turkey, Vietnam, Thailand and Indonesia. Mexico (99,898 mt, or 9 percent of exports), Canada (26,164 mt), Egypt (21,397 mt), Colombia (19,685 mt) and Vietnam (19,580 mt) captured most of the remaining global market for U.S. DDGS. Year-to-date exports for 2015 are 4.5 million mt, implying an annualized 10.89 million mt—more than a fourth of total U.S. production.

#30

For more news, go to www.agri-pulse.com.