WASHINGTON, Feb. 4, 2015 – A USDA report says the country’s cattle herd is up for the first time since 2007, but an industry expert says growth will have to continue and production will have to become more efficient or the industry risks permanent loss of processing facilities and other infrastructure.

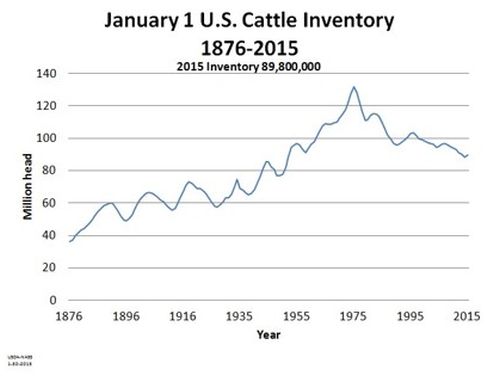

A report from the National Agricultural Statistics Service shows the Jan. 1 cattle and calf inventory was 89.8 million head, a 1 percent bump from a year earlier. The beef cattle sector offered other positive signs: beef cows were up 2 percent at 28.7 million head and beef replacement heifers were at 5.8 million head, up 4 percent.

The rebound follows tumultuous years in the beef cattle industry after drought and loss of grazing acres forced producers to scale back their herds. Now, a Rabobank report says producers “are feeling pressure from the markets and industry to expand – and expand quickly.”

The rebound follows tumultuous years in the beef cattle industry after drought and loss of grazing acres forced producers to scale back their herds. Now, a Rabobank report says producers “are feeling pressure from the markets and industry to expand – and expand quickly.”

The Rabobank report focused on ways that the cattle industry could expand and increase efficiency, mainly through increased use of confinement in breeding operations. Much like the benefits of confinement practices touted in the pork and poultry industries, the report notes a nutritional benefit that is added under confinement. It says some operations already using a confined feeding program have noticed a reduction in feed requirements of up to 20 percent depending on the reproductive stage of the cow.

“Increased efficiency from the cow herd and healthier animals is what makes the confined and semi-confined programs viable and valuable,” according to the report. “The ability to adjust the nutritional needs of the cow to the pregnancy/post-calving stage, and the ability to sort cows and adjust feed requirements based on their body condition scores isn’t an option with open grazing.”

Don Close, the author of the Rabobank report, said confinement and semi-confinement could be potential answers to three main impediments to expansion: high capital barriers, declining availability of acres suitable for grazing, and aging producers. In an interview with Agri-Pulse, he said the “infrastructure” in the cattle industry – feed lots, processing facilities, etc. – has to be maintained and kept in use to prevent long-term issues.

“We desperately need to expand the base under the marketplace and expand these cow/calf numbers to meet the requirements of the infrastructure,” Close said. “If we lose that infrastructure, it’s not likely we’re going to get it back.”

Close noted that purchasing or renting grazing ground can involve a substantial multi-year investment that is cost-prohibitive to many, specifically young producers trying to enter the industry. Close said most of producers currently using confinement in their operations were able to pay for their new facilities in two or three years, “and that was before we had these extreme returns that we’re looking at right now,” Close said.

The jump in the cattle herd and prices might be the beginning of a trend. As more heifers are kept for breeding, tight supplies will continue in the marketplace, and the dual-demand for those heifers could drive prices higher at the same time the herd continues to grow. Close predicts a 2 percent jump in herd growth in 2016 and says returns “will remain elevated for several years” as the industry works toward rebuilding the drought-depleted herd.

#30

For more news, go to www.agri-pulse.com.