The report points out the central problem with the Renewable Fuel Standard (RFS): “a trade-off exists between the goal of limiting the cost of complying with the RFS (for example, by reducing the requirements for cellulosic biofuels) and the goal of providing a strong incentive for the development of better technologies for advanced biofuels.”

In other words, compliance costs drop if the EPA reduces its RFS volume requirements as it proposed last November. But even proposing to lower the requirements does exactly what has happened this year in the biofuels industry: investors flee, forcing companies to postpone or abandon plans for improving operations and building commercial-scale biorefineries.

CBO Senior Advisor Terry Dinan explained in an Oct. 21 Resources for the Future seminar that the concerns about the RFS and calls for its repeal have focused on:

• whether the biofuels industry has the capacity to supply the steadily increasing volumes which Congress mandated in the 2007 Energy Independence and Security Act (EISA),

• whether steadily higher volumes will increase prices for food and transportation fuels, and

• whether increasing biofuels use will actually generate the intended reductions in greenhouse gas emissions.

Currently, the Renewable Fuels Association (RFA) is lobbying hard to get Big Oil’s branded gas stations to follow the example of independent stations which have installed popular blender pumps to give consumers the choice of filling up with E15 (15% ethanol) rather than the standard E10 – and give drivers with flex-fuel cars the choice of E85. RFA CEO Bob Dinneen insists that consumers choose higher blends and the better value of higher biofuels blends when given the choice.

Dinneen also says that if the EPA reduces RFS volume requirements as it proposed last November, RFA is prepared to challenge the EPA in court.

In response to calls for greater availability of higher blends, CBO acknowledges that “More ethanol could be accommodated in the fuel supply” with higher blends. But it concludes that at present, fewer than two percent of filling stations in the United States sell high-ethanol blends.”

CBO considers three possible paths forward for the RFS, picking 2017 as its test-case year:

1. EISA volumes scenario: maintaining mandated requirements for renewable fuels, including advanced biofuels, “but not the requirement for cellulosic biofuels, because the capacity to produce enough of those fuels is unlikely to exist by 2017.”

2. 2014 volumes scenario: Have EPA “keep the RFS requirements for the next several years at the same amounts it has proposed for 2014.”

3. Repeal scenario: Congress “would immediately abolish the RFS.”

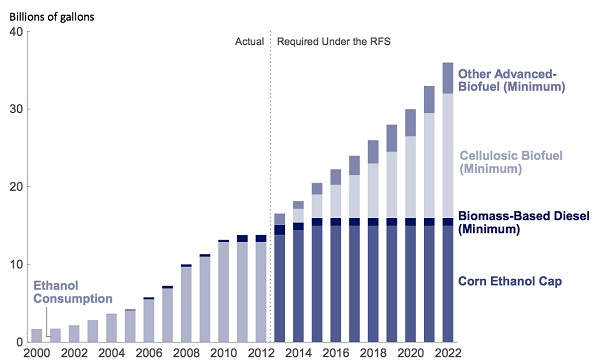

CBO sees the 2014 volumes scenario as “much more likely than the EISA volumes scenario, which would require a large and rapid increase in the use of advanced biofuels and would cause the total percentage of ethanol in the nation’s gasoline supply to rise to levels that would require significant changes in the infrastructure of fueling stations.” EPA’s proposal would cut the total RFS mandate from 18.15 billion gallons for 2014 to 15.21 billion gallons. EPA’s proposed corn ethanol part of that mandate would drop from 14.4 billion gallons for 2014 to 13 billion gallons, well below the 13.8 billion gallons required in 2013.

Reflecting the difficulty of developing cellulosic ethanol, EPA’s 2014 proposal cut the mandated cellulosic requirement from 1.75 billion gallons to 17 million gallons. But CBO points out that EPA’s lowered requirements “have probably contributed to the slowing growth of cellulosic production capacity.”

Past Use of Renewable Fuels and Future Requirements of the Renewable Fuel Standard

Source: Congressional Budget Office

Dismissing one of the critics’ main arguments, CBO concludes that “Food prices would be similar whether the RFS was continued or repealed.” If EPA kept the high EISA biofuels requirements rather than lowering them to the levels its has proposed for 2014, CBO forecasts that increased corn demand would boost corn prices about 6%. But CBO finds the total impact on U.S. food prices would be about one-quarter of one percent.

For transportation fuel prices, CBO find that for the 2014 volumes scenario or for RFS repeal, fuel prices “would probably be roughly the same” because “Fuel suppliers continue to use a 10% blend because ethanol is projected to cost less per gallon than gasoline in 2017.” If EPA maintains the higher EISA volumes, CBO finds that:

• petroleum-based diesel would go up 30 cents to 51 cents per gallon, or 9% to14 %,

• E10 would go up 13 cents to 26 cents per gallon, or 4% to 9%, and

• E85 would drop 91 cents to $1.27 per gallon, or 37% to 51%.

CBO warns, however, that “because little information is available about how the supply of and demand for renewable fuels respond to changes in their price, those estimates are highly uncertain.”

For greenhouse gas emissions, CBO predicts that reductions generated by the RFS “would be small in the near term but could be larger over the long term.” CBO concludes that “The success of the RFS in reducing the emissions from transportation fuels will depend mainly on the extent to which it causes people to substitute advanced biofuels – particularly cellulosic biofuels – for gasoline or diesel over the long run.”

E15 offers one solution to the demand-limiting “blend wall” created by most gasoline containing just 10% ethanol. But the CBO report concludes that:

• There is disagreement about the risk of damage with use of E15

◦ EPA has certified that vehicles built since 2001(60 percent of current vehicles) can run on E15 without damage

◦ Many automakers disagree with EPA and discourage the use of E15

◦ Ford and GM have stated that vehicles built since 2012 can use E15

• Until mid-2012 no stations offered E15

◦ A small number of stations now have pumps

◦ Offering both E10 and E15 would require new pumps and storage tanks, and would raise liability concerns if E15 was put in vehicles built before 2012

For more information, read the CBO’s Oct. 21 RFS Presentation at Resources for the Future and the CBO’s June report on “The Renewable Fuel Standard: Issues for 2014 and Beyond”

#30