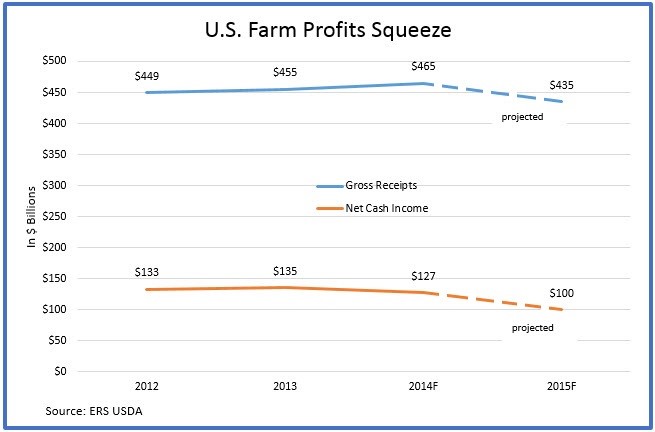

WASHINGTON, Aug. 26, 2015 - Cash is pouring into U.S. agriculture this year, but net farm income is highly disparate and, overall, will end up thinner than in the more recent economically flush years.

USDA on Tuesday projected 2015 crop and livestock receipts to total $388 billion. That’s down more than $32 billion from last year, owing mostly to reduced production and lower prices for the country’s two biggest crops – corn and soybeans – and lower prices for hogs and milk.

Expected total cash receipts are about 92 percent of the 2014 record of just over $420 billion – while all other categories of farm income, including machine hire, custom work and forest products, are projected to be up modestly. USDA says total receipts for fruit, nuts, vegetables and other specialty crops will top $76 billion, a record, owing to high market prices, despite the Southwest’s drought and Florida’s citrus greening losses.

Note, too, that USDA projects cash farm income – representing what farmers actually buy and sell through December – will top $100 billion, exceeding “net farm income” by 72 percent.

Note, too, that USDA projects cash farm income – representing what farmers actually buy and sell through December – will top $100 billion, exceeding “net farm income” by 72 percent.

That is largely because farmers will sell down their crop and livestock inventories more than last year in order to pay living and operating expenses and pay off debt, explains Mitch Morehart, a USDA economist who compiles the estimates. Cash income “depends on how much of this year’s production gets sold this year,” he says.

But soft markets will continue for most top U.S. farm commodities. The national monthly price index for June, the latest one, has crop prices to farmers 11 percent lower than a year earlier; livestock sector prices, 5.5 percent lower. On a global scale, the food commodities index of the United Nations Food and Agriculture Organization has already dropped by 18 percent from the 2014 average, and its dairy products benchmark is down 33 percent.

At the American farm operating level, “There’s a lot less room for error at these prices,” says Bob Young, the American Farm Bureau Federation’s chief economist. Weak agricultural markets will persist for a year or two, he says, and “farmers will be tightening up.”

Even with the second-biggest U.S. soybean crop and third-largest corn crop on tap, the generous net margins of $1,000 per acre or more for a few years are gone. Gary Schnitkey, University of Illinois economist, explains the situation in his operating budget and income summary for a highly productive grain farm. Even if selling corn at $4.20 per bushel and soybeans at $10 (both more than USDA now expects), farmers who combine cash-rented and share-rented land with owned land will lose money overall, he says.

Schnitkey reports that cash rent, now typically a lofty $285 an acre, plunges the budget into the red, and he says such operators will have to extract lower rental rates, plus trim seed, fertilizer, chemical, machinery and other expenses to achieve a break-even budget next year.

Meanwhile, USDA’s outlook notes the timely arrival of the 2014 farm bill’s first round of its crop supports. They’ll be based on the full 2014-15 marketing year and will reach most recipients this fall. Total crop payments will jump from $1.5 billion last year to $6.1 billion this year, even though yearly payments of $650 million to tobacco growers who transitioned away from that crop ended last year. The big increase, “reflects the transition into the new programs,” including the new Agricultural Risk Coverage and Price Loss Coverage, notes Morehart. The total also includes $3.8 billion in loan deficiency payments and gains on crop marketing loans, nearly all on the cotton crop. [Separately, disaster payments, mostly to livestock operations, were $4.7 billion last year but just $1.6 billion this year.]

On agriculture’s livestock side, 2015’s overall profits are moderately strong because markets are so varied. With the U.S. cattle herd now the tiniest since the 1950s, fat cattle prices are still near a burly $150. Also, after bird flu wiped out 48 million or more laying hens and turkeys in the Midwest this year, wholesale large eggs are fetching around $2 per dozen, about double year-ago prices, and frozen turkeys, at nearly $1.30 a pound, are running 20 percent above the August average.

However, with domestic demand flat and meat export demand down from last year, hog and chicken slaughter exceeds demand and prices for both have plunged far below year-ago levels. Dairy farmers are squeezed, too. Owing in part to the strong dollar, dairy exports are down this year and imports are higher, while domestic demand is flat and U.S. milk production is running about 1 percent higher than last year. So the all-milk price to farmers, which averaged $24 per hundredweight (cwt) last year, has withered to under $17.

Rob Vandenheuvel, manager of the Milk Producers Council in drought-plagued California, where dairies are paying a whopping $250-$275 a ton for alfalfa hay, says of dairy farmers: “Everybody is taking a hit; there is no way around it.”

With grain prices down – hay, too, in most areas – USDA estimates average dairy cow feed costs have fallen to about $12/cwt of milk produced, down by $4 versus last summer. But, Vandenheuvel says, basic operating costs for California dairies are around $19/cwt of milk, and “the milk check is not covering those costs.” Besides that, because average feed costs have fallen, a new 2014 farm bill program to subsidize dairy farms when the gap between feed costs and milk prices expands too much has not yet triggered.

Also out West, experts at University of California, Davis, project the relentless drought there will choke $1.8 billion from the state’s annual pre-drought farm economic output -- along with about 10,000 jobs ag-related jobs.

Nonetheless, says Richard Howitt, UC Davis economist, farmers have been converting a lot of acreage to high-value fruit, nut and vegetable crops were water is available even while idling land traditionally seeded to lower-valued field crops. “They are moving crops over to the coast, and some are moving them up north to the Sacramento Valley, where there are better water supplies,” he says. On one hand, he says, the drought has idled 9 percent more cropland than would normally be fallowed: The state’s rice acreage is down by a third since 2011, for example. But meanwhile, the drought’s silver lining has been robust prices for fruits and veggies there this year. As a result, he says, the total value of California’s 2015 farm output may exceed last year’s.

Another bright spot in this year’s slowing farm economy is the first decline in total expenses since 2009. Few expenses are increasing, and the outlook for 2016 is favorable for farmers. Seed and chemical prices are flat; some fertilizers are cheaper than last year, and the fuel price outlook is especially friendly. The Energy Information Agency pegs 2015 retail average for regular gasoline at just $2.11 a gallon for the fall quarter and only $2.50 for 2016; diesel fuel, up just a few cents from this year -- to $2.81 a gallon.

USDA projects a 25 percent jump in interest costs, stemming largely from farmers borrowing more heavily and a rise in farm mortgage rates. Meanwhile, operating credit rates remain friendly, with USDA’s seasonal crop-secured loans still at 1.25 percent, and banks making most farm operating loans at 4-5 percent, the Federal Reserve reports. Farm labor costs will be up 4 percent overall, USDA estimates, but the increase results partly from increased hirings. Meanwhile, USDA’s surveys say farm wages rose just 3 percent in the past two years.

#30

For more news go to: www.Agri-Pulse.com